Those of my great-grandparents who immigrated to the United States came here looking for the American dream, but their grandchildren grew up in poverty. My parents never thought they would attend college, and they took the untraditional route when they did. My Dad earned his associate’s degree online while working full time. My Mom had her first child when she was about my age, but she used a federal Pell Grant to attend nursing school and worked her way through 21 credit hours a semester.

My parents were strong. It certainly wasn’t easy, but a college degree was important to them, because they wanted to give their children a better life.

I am thankful for them. But I know there are still millions struggling right here in the United States who can’t even afford basic healthcare or food. If we gave them access to higher education, we could put, maybe not the American dream, but their dreams, within their grasp.

Most of us can’t actually afford our degree, but we all dream of a well-paying job. So over half of all IU students take on debt, and jump through endless hoops to get scholarships and financial aid to ease some of the burden.

There are many for whom this is not enough. Those who borrow still end up paying $26,201 on average, according to IU President Pamela Whitten.

It is evident, then, that financial aid is insufficient to ease the burden on those who most need it. A government-funded, debt-free program would fix this by encouraging more low-income students to attend college as well as helping them succeed, and their success will be our nation’s greatest success.

We would once more set the example for what a democracy should look like if we made college a reality for the poorest in our nation.

Doing so would provide a multitude with financial stability. According to Georgetown University’s Center on Education and the Workforce, college graduates even gained jobs during the 2008 recession.

This stability allows college graduates to invest, volunteer, and donate to charity more, while also committing less crime than non-graduates, according to economist Philip Trostel. If we could give low-income communities that sort of stability, our society would be much better off.

Unfortunately, the government cannot, and probably should not, just make college free. At least not for all of us, because it is neither sustainable nor equitable. According to the report “Senate Bill 81: The First Term of the Oregon Promise,” 60% of the benefit of Oregon’s free college program went to the top 40% of income earners in 2016, yet the program, like Pell Grants and our own 21st Century Scholarship, leaves low income students to worry about room and board, books, and fees.

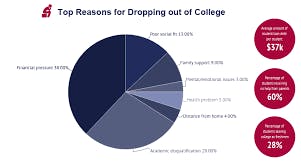

So many are left struggling to attend classes during the day, and working at night to make ends meet, while fitting in studying and homework somewhere in between. It's no wonder, then, that 38% of college dropouts cite financial pressures as the reason for leaving, and many more academic disqualifications, according to research analyst Melanie Hansen in her 2021 report “College Dropout Rates.”

That burden presents a major problem, but I come to you today with a potential solution.

The solution is to go debt-free. As a start, anyone whose household makes under $60,000 should pay nothing to attend college, and those that make more should pay more in a tiered system, much like the Ivy League Universities. The government could cover the full cost, from tuition, to room and board, to fees, and books as well as a $200 per month living stipend for all full-time enrolled low-income students, and a percentage of that for those not full-time enrolled.

This life-changing grant would enable low-income students to attend any public school in the nation without cost, making them much more likely to attend and much less likely to drop out.

According to Georgetown University’s Center on Education and the Workforce, a debt-free college program like this would only cost 75 billion dollars per year. While that may seem like a big number, according to the Treasury Department, the richest 1% of Americans are simply choosing not to pay 163 billion in taxes a year, through tax fraud and loopholes. If the IRS were given more resources to combat this then this debt-free plan could easily be paid for.

This could be accompanied by lowering the corporate tax rate and progressively raising the income tax. Businesses can avoid taxes way too easily, or pass it on to consumers like us by raising prices, or to their workers through lower wages. Therefore, focusing on raising the income tax (and capital gains tax) on those who benefit most from an educated workforce (the uber-wealthy) could help pay for this plan, and increase investment in American businesses by getting rid of the double taxation (money made by businesses is taxed, and then the earnings that the stockholders make are also taxed) that so often discourages potential investors from investing in America.

A higher estate tax on the wealthy could also force them to spend, invest, and donate their money before they pass away to do good with it in their lifetimes, rather than passing it all on to their children.

The upfront cost would be large, but as time goes on debt-free college would pay for itself, while changing people’s lives for the better.

If we ensure that the forgotten millions in our nation are able to attend college and make successful careers for themselves, they could declare independence from poverty, debt, and government assistance, like my parents.

If we leave things the way they are, the divide between the rich and the poor will continue growing, and communities of color will continue to be the hardest hit, according to the Center for Law and Social Policy. As fewer and fewer people yield more and more power, our nation will become apathetic and weak.

In the end, America will fall behind the rest of the world if something is not done. If that happens, we are without excuse. We know the problem, and we have the means to fix it.

If we gave all of America’s forgotten talent the opportunity to get a degree, we might just discover the next George Washington Carver, Marie Curie, or even Albert Einstein.

This April, Senator Brian Schatz introduced a bill called the “Debt-Free College Act of 2021.” Like myself, he fervently believes that “we ought to cover the full cost of college for people who can’t afford it before we cover tuition for people who can,” and his plan includes much of what I have spoken about here.

The first step we can all take, then, to reduce the burden of college debt on low-income students is to sign the petition to support this Bill. You can also make sure to call Indiana Senators Todd Young and Mike Braun and show them your support for this bill. And, when the time comes, make sure to vote in the primary elections on May 3rd. That way you can make sure, regardless of your political affiliation, that your party’s candidates actually represent you, as a college student.

These actions need to be taken because the price of college is a severe problem, and the scholarships and financial aid we have now are not doing enough. If we enacted a debt-free college plan, it would lift a multitude out of poverty, and fulfill the dreams of many parents like my own to give their children a better life. If we want to see a more inclusive future for America, together, we must keep our elected leaders accountable.

The Price of College Debt

Heads up! This article was imported from a previous version of The Campus Citizen. If you notice any issues, please let us know.