I never saw $90 of my last paycheck.

If you are one of the 43% of full-time undergraduate students that are employed nationwide, you too have probably found a large discrepancy when comparing your hours worked and wage rate with your actual paycheck.

That money went right into the coffers of the Federal Government.

$49, or 10% of my last paycheck, went to federal taxes.

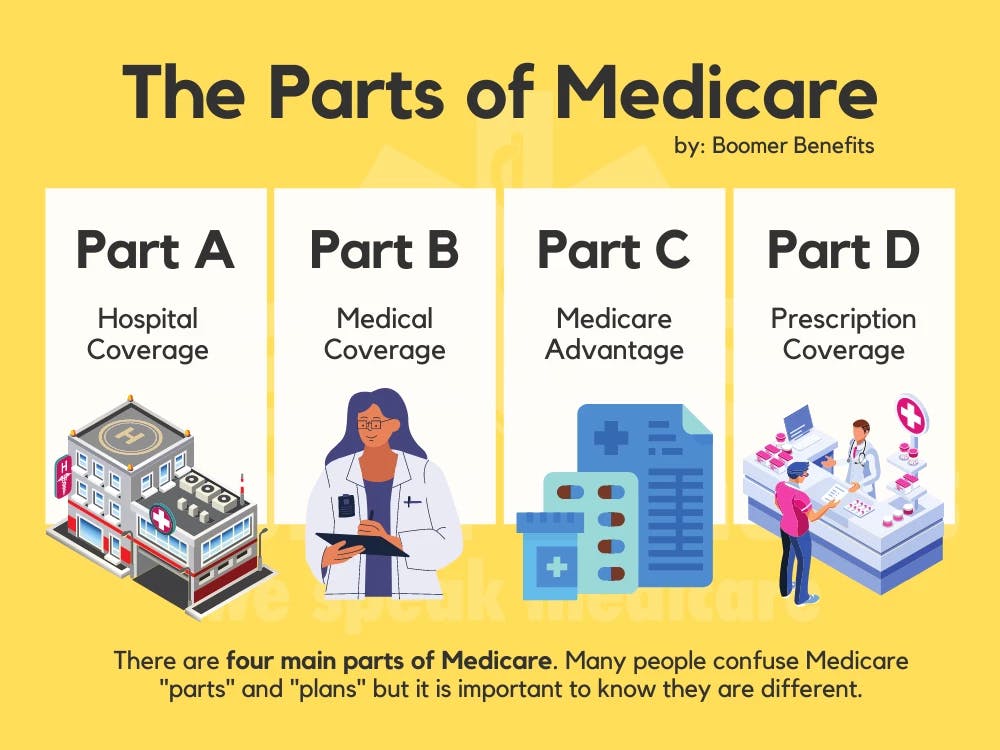

About $7.77 went to pay for Medicare, which was 1.45% of my paycheck. The other $33.23 went to pay for Social Security, which was 6.2% of my paycheck. My employer contributed the same amount.

If you are lucky enough to work for the university, you are likely exempt from paying the latter taxes.

I wish I could have invested that money in something useful, like Bitcoin.

It may have lost 52% of its value in the last year, but the government hasn’t been trending too well lately, either.

Some part of that $33.23 was used for benefits, given to those cannot work due to a disability. Their immediate family members also qualify to receive some benefits. Another part was used for survivor benefits, given to those who have had a spouse, parent, or legal guardian pass away.

You generally have to pay into the system to get the benefits, and to some degree, you are paid more if you contribute more. This is why it is considered a social insurance program.

The rest was taken ostensibly to pay for my retirement benefits.

SSA Card | Photo Courtesy of Westmoreland County, Virginia

However, it is actually being used to pay for current retirees, through the Social Security Trust Fund. The money buys special government bonds, which are sort of like an I.O.U. that is not supposed to lose value, like a regular government bond can. The government then uses this money either to pay current beneficiaries or to borrow for other, unrelated programs.

In reality, then, its designation as a “social insurance program” is not completely honest. The program was created during the Great Depression, so it would have been politically difficult to delay benefits for the elderly until they had contributed a fair amount to the system.

For example, Ida May Fuller was the first person to start receiving monthly benefits check in 1940 at age 65. She paid approximately $24.75 into the system and lived another 35 years to collect $22,888.92 in benefits.

Who paid for that, you might be asking?

The people who can’t vote, or don’t vote as often. Young people (and middle-aged workers) still do. Because the pool of beneficiaries historically has been growing faster than the pool of workers, the system has become a Ponzi scheme.

A Ponzi scheme, named after Italian businessman Charles Ponzi during the 1920s, is a form of fraud that lures investors into believing profits come from productive business activity, when in actuality the profits are just redistributed from new investors. It can pretend to be sustainable as long as people continue to believe in the system and new investors continue investing enough money to pay old investors.

Just the same, Social Security depends on money from new investors (young workers) to pay old investors (retirees).

However, the workforce is aging faster and living longer, and there are not enough people being born and entering the workforce to sustain it, nor are there enough young people immigrating to the United States to offset this trend. In 2005, for example, there were 3.3 workers per beneficiary, and the Social Security Administration expects it to drop to 2.1 by 2040, approximately when they are expected to become insolvent, which means a decrease in benefits for everyone.

By the time the Baby Boomers all retire, let alone when we get our chance to migrate to Florida and sip margaritas on the beach, there might be no money left, or the age of full benefits will be 150.

The system’s continued existence depends on young people not having the financial sense to realize that it is a scam.

Some politicians are trying to fix this problem by reducing benefits now. Others want to get rid of payroll tax limits for the wealthy. The problem with the latter is that too much of the burden would fall on the middle class.

So how can we fix it, without screwing people over who have already paid into the system?

The first thing we should do is replace the regressive payroll tax, specifically the 6.2% taken from your paycheck for retirement benefits.

Most Americans dislike flat taxes. 6.2% matters a lot more to someone living paycheck to paycheck than to someone with six revenue streams, two vacation homes, and a membership at the country club, especially when that 6.2% is capped at an income level of $147,000 per year.

Even former President Trump adopted a proposal to defer employee payroll taxes, seeking to stimulate the economy and provide relief for workers during the pandemic, with mixed success.

The next step would be to pay for the Trust Fund out of the general fund, much like Trump promised to do if he would have been reelected.

Unlike Trump’s initial plan, which relied on a questionable premise of massive economic growth in the midst of the COVID-19 Pandemic, such a plan ought to be accompanied by a progressive income tax increase in accordance with the estimated cost of sustaining the Trust Fund. This would mean those that make more would pay a higher percentage of their earnings.

This would partially address the biggest problem with Social Security: the fact that its finances are directly tied with the size and demographics of the population.

Between 1979 and 2020, worker productivity increased 62.5%, but worker wages only rose 15.9%. That discrepancy implies there is a lot of wealth being created by the workforce that is not being accounted for in paying for their retirement. A progressive income tax would take into account some of this wealth and better redistribute it.

Replacing the current corporate income tax and employer payroll taxes with a general 7.65% tax on corporate income, to be used to pay for Social Security and Medicare, would further serve this end. It would also encourage companies to hire more employees, raise wages, or invest, without having to pay more in payroll taxes. Self-employed workers would no longer be punished for their ingenuity and work ethic by having to pay both the employee and employer portions of Social Security.

Lost revenue could be replaced with a higher capital gains tax, which would ensure that if someone makes their money off of stocks instead of a company paycheck, they still pay their fair share. Of course, most rich people who “don’t pay their fair share,” tend to live off of money that is borrowed from the value of their stocks, reflecting the need for a better system of taxation, such as a wealth tax.

A long-term increase in worker take-home pay should also increase household spending, especially for those that live paycheck-to-paycheck, thus stimulating the economy.

If college students had that much more money to spend, Starbucks might become a Fortune 100 Company. Of course, students could also use that money to pay off debt or for other living expenses.

The income tax has less of an impact on spending because workers are already able to defer payment until the dreaded April 15th, unless it is withheld by their employer. The larger amount of cash on hand, furthermore, would enable low-income individuals to spend money on higher cost goods and investments.

In addition to transitioning to a progressive income tax, workers should also be allowed to receive full retirement benefits while continuing to work.

We depend on aging workers to fill many important jobs, especially in healthcare. For example, 22% of psychiatrists in Indiana are 65 or older. Allowing them to receive full benefits might encourage more aging psychiatrists to continue working, which would be beneficial considering that Indiana ranks 43rd in the nation for mental health treatment access according to Mental Health America, a community-based nonprofit promoting mental health advocacy and education.

Since Social Security is considered taxable income, these workers would end up contributing more to the system in a higher tax bracket then if they had subsisted off of retirement benefits alone.

Overall, pooling money with the general fund would centralize necessary resources, while reducing some of the paperwork and qualifications to receive benefits would decrease the bureaucratic costs of maintaining the Social Security Trust Fund.

Doing so will ensure that those who need Social Security the most will continue to be able to receive it for years to come.

I’ll be eligible for full benefits in 2070. For all I know, we could be wiped out in nuclear war by then, and Medicare does not even cover radiation sickness medication. I would like more control over how this money is invested and when I get it, but that would take a lot more than a progressive income tax. Expect more soon on how to give young people the control to find a better alternative to the current system.

Jacob Stewart is a junior majoring in neuroscience at IUPUI and the campus editor of The Campus Citizen. He has a strong interest in policy and economics, in addition to science and education. He certainly isn’t an expert, so you should take what he says with a grain of salt, although he has read a bit of Sowell, and a bit of Smith